PET FOOD MARKET IN THE US: The current online landscape in the pet industry

Question Of Pet Care online growth

How focused should I be on building my brands online sales?

Over the last decade, the average US consumer has been shifting from buying in a retail store to ordering online. For the past five to six years, this has been a major, negative trend impacting all brick and mortar (B&M) stores and the pet specialty stores are no different. This trend has led to declining brick and mortar store sales and increasing digital sales.

As brands and retailers determine how to move forward, this article provides an overview of online pet care sales. This will be the first in a series of articles that offer insights, and taken together, can be helpful to your pet care business.

The growth of overall E-Commerce and it’s affect on Pet Supplies

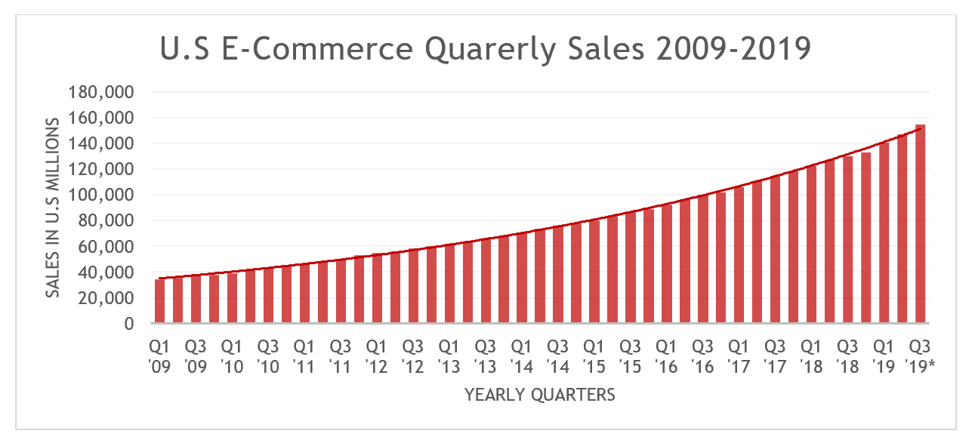

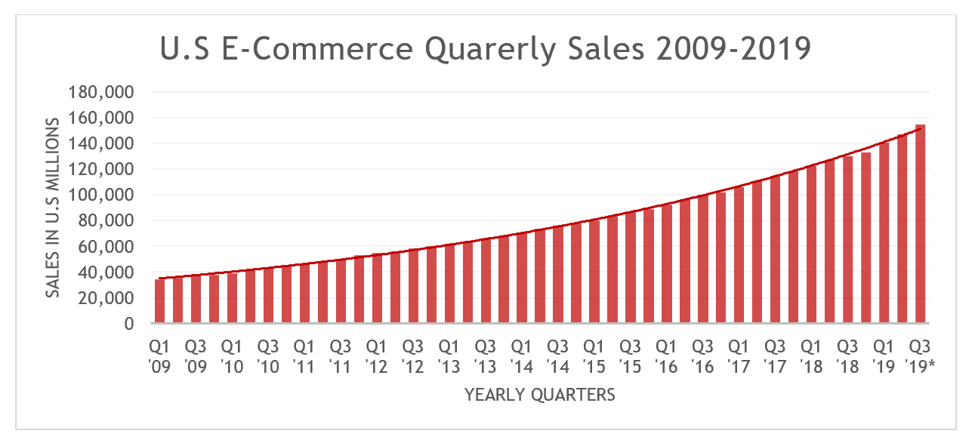

Since 2009[1], U.S. e-commerce sales

have grown at a rate of 13% annually- beginning at 34 billion U.S. Dollars to

154 billion U.S. Dollars in Q3 2019. Reflecting on our daily habits, we know

e-commerce is now a natural habit for us and fellow consumers. However, the

data shows that E-commerce is growing at a staggering rate. More and more

people are turning to online solutions for purchasing goods. All consumer

industries are feeling the ripple effect of this trend. But what does this mean

for the pet food industry?

[1] US Census Bureau; Q1 2009 to Q3 2019 Quarterly Ecommerce Retail Sales Estimates

E-COMMERCE IMPACT ON Online Pet Supplies

Apply a dual focus to conventional retail and e-commerce sales set companies up for success. Neglecting to focus on both leaves behind opportunity to sell to consumers who prefer either option behind. As the e-commerce space becomes more and more important, sales from traditional big box stores are no longer the dominant growth engine.

Sales aren’t the only area e-commerce has grown- there are now more than 100 websites where consumers can buy pet supplies. And, while many view Amazon and Chewy as the dominant market players, our research shows Walmart and local specialty pet retailers aggregated are leaders respectively in the marketplace. A survey conducted in late 2019 illustrates this point further. Of the respondents who reported having purchased pet products online, 23% said Amazon, 22% said Walmart.com, 20% said Chewy.com and 15% purchased from pet specialty store websites.[1] The chart below illustrates how close together each retailer truly is. It would make sense to partner with the leaders- Amazon, Walmart, Chewy, and pet specialty stores. That said, there’s benefit to partnering with independent specialty retailers’ sites as they may result in lower cost per sale and earn your brand higher customer loyalty because of those savings and the quality of your product.

[1] Packaged Facts; Petfood Industry, July 2019, page 20, Question asked: “Websites used in the last three months to purchase pet products in the United States in 2019”

Summary

Data confirms what many of us have thought: e-commerce is a critical sales channel and customer engagement opportunity. The data also clarified that traditional brick and mortar retailers won’t be disappearing any time soon. With that said, we recommend taking a dual approach to engage e-commerce and brick and mortar retailers to maintain business- building initiatives at traditional retail and leverage new e-commerce opportunities.

Recent Comments